This is the most efficient and professional LTD formation service I’ve ever used. My company was successfully registered in the UK, and they also took care of the registered address and VAT setup. I’m very satisfied with the quality of their service.

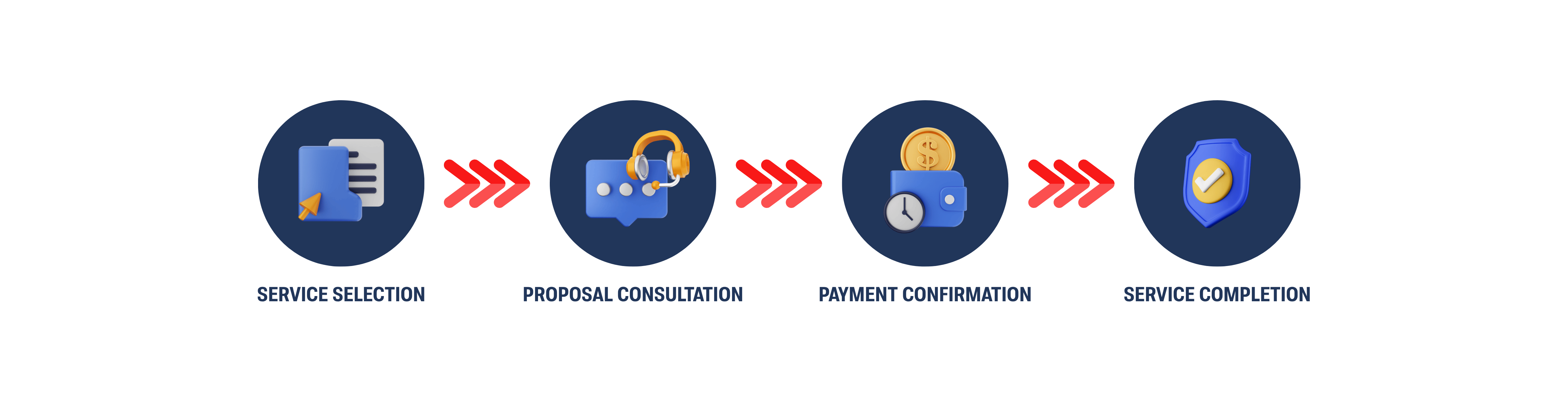

Amazoker offers comprehensive support for businesses, covering company formation, tax filing, annual renewals, and legal compliance across multiple countries.

Whether you’re a first-time entrepreneur or expanding internationally, we help you save time, stay compliant, and operate smoothly—no local presence required.